Okay, so check this out—managing your Solana portfolio feels like juggling flaming torches sometimes. Seriously, between staking, yield farming, and trying to pick the right validators, I’ve had my share of headaches. Wow! The crypto space, especially on Solana, moves fast, and if you blink, you might miss some juicy gains or, worse, lose out because you overlooked something critical.

At first, I thought crypto wallets were just about safekeeping your tokens. But then it hit me—your wallet is basically the cockpit for all your DeFi maneuvers. You can track your portfolio, stake, delegate to validators, and even dive into yield farming without hopping between a dozen apps. But the catch? Not all wallets give you that seamless experience, and picking the right validator is way more nuanced than just going for the highest APY.

Something felt off about relying on just numbers in validator selection. Sure, a validator promising 8% yield sounds great, but what about their reliability, history of uptime, and community reputation? On one hand, you want to maximize returns, though actually, a validator with sketchy past performance can lead to slashing penalties, which can hurt your earnings big time. It’s a balancing act that’s rarely straightforward.

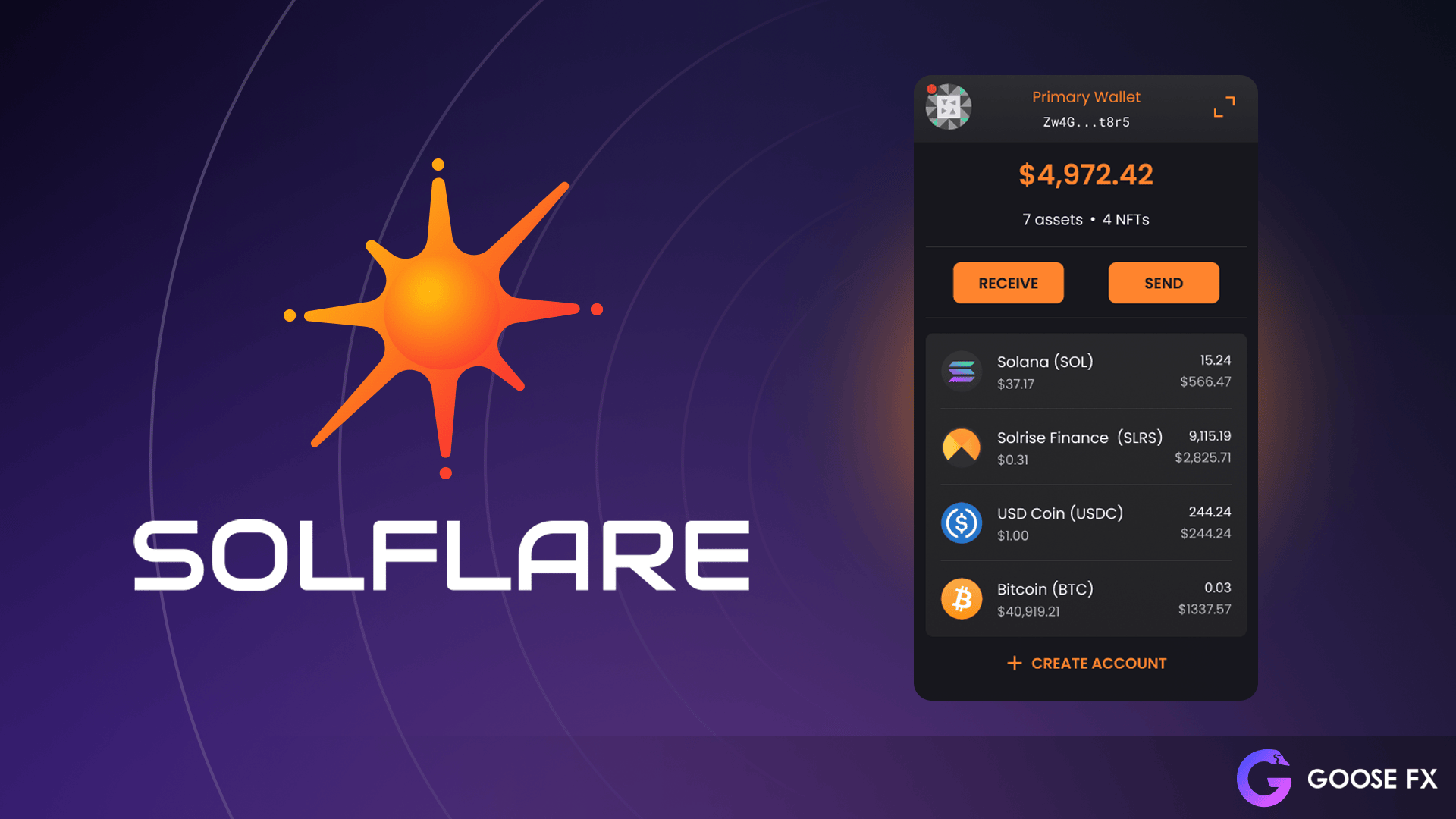

Now, I’m biased, but in my experience, having a wallet that integrates portfolio tracking with validator analytics is a game changer. It’s not just about numbers on a dashboard—it’s about contextual info. For example, when I use Solflare, I can see not only my staking rewards but also validator performance stats, which helps me decide if I should switch delegation. By the way, if you haven’t checked it out yet, you can grab the wallet here. It’s pretty slick.

Hmm… something else that bugs me is how yield farming on Solana can feel like the Wild West sometimes. Pools pop up, disappear, and the APYs fluctuate wildly. Really? It’s not just about chasing the biggest numbers; you gotta think about impermanent loss, pool liquidity, and the project’s longevity. I remember jumping into a pool that looked promising only to see the rewards tank because the project lost steam.

Validator selection deserves more love than it gets. People often overlook how decentralization affects their staking decisions. Delegating to a mega-validator might give you steady returns but could concentrate power, which goes against the ethos of blockchain. Smaller validators might be riskier but help keep the network healthy. Initially, I leaned toward big validators, but after diving deeper, I realized spreading stakes across multiple validators can be smarter, even if it’s more work.

Here’s the thing. Portfolio tracking tools that combine real-time data with intuitive interfaces have gotten better, but there’s still room for improvement. The problem is the data fragmentation across DeFi platforms—staking rewards here, farming yields there, validator info scattered all over. A unified dashboard that feels natural to use? That’s gold. Solflare’s wallet interface tries to tackle this, making it easier to monitor your staking and farming activities without bouncing around between sites.

Speaking of farming, I’m not 100% sure if the average user fully grasps how yield farming risks stack up on Solana’s ecosystem. High returns are enticing, but they often come with hidden dangers like smart contract bugs or sudden liquidity drains. I’ve heard stories where folks lost a chunk of their principal because they didn’t vet the farming protocol thoroughly. So yeah, due diligence is very very important here.

Oh, and by the way, if you’re new to staking and farming on Solana, it pays to start small and get familiar with validator reputations and pool mechanics. Don’t rush in chasing FOMO gains. Watch your portfolio growth, keep an eye on validator uptime, and understand how your rewards compound over time. It’s all connected, and the right wallet can help you piece that puzzle together more easily.

One thing I learned the hard way is that your wallet choice impacts how you engage with the ecosystem. A wallet with integrated portfolio tracking and validator info reduces the mental load when managing multiple assets and staking positions. It feels more like piloting a well-designed plane instead of a rickety bike. If you want to explore wallets that support these features, you can download one here—trust me, it’s worth a look.

Yield farming on Solana isn’t just about plugging in your tokens and watching profits roll in. You gotta think about the underlying tokenomics, how rewards are distributed, and whether the farming protocols have strong communities supporting them. Sometimes, the hype overshadows fundamentals, leading to disappointment. I’ve seen projects with flashy APYs that quickly dried up because of poor design or pump-and-dump schemes.

Validator selection also ties into your long-term staking strategy. If you’re planning on staking for months or years, picking a validator with a solid track record and community trust matters more than chasing the highest immediate returns. Validators that maintain high uptime, actively participate in governance, and engage with the network tend to be safer bets. Though, no validator is 100% risk-free, so spreading your stakes can help mitigate slashing risk.

Something else to consider is how portfolio tracking tools handle multiple wallets or cross-chain assets. As DeFi gets more complex, many users hold tokens across different wallets or even blockchains. Tracking all that manually is a nightmare—some wallets are starting to offer multi-wallet views, which is handy, but still evolving. I’m watching how Solflare and others improve on this front—it could be a game changer for serious DeFi users.

Okay, so here’s a quick personal anecdote: I once delegated to a validator just because they had flashy marketing and a high APY. Within a couple of weeks, their performance dipped, and I got penalized. Ouch. After that, I switched to validators with less hype but consistent uptime and community transparency. My rewards stabilized, and honestly, I sleep better at night knowing my stake isn’t at unnecessary risk.

Now, I know this isn’t the sexiest topic—portfolio tracking and validator selection sound dry—but they’re the backbone of a solid Solana DeFi experience. Without good tools and a clear strategy, you’re basically flying blind. For anyone staking or yield farming seriously, it’s worth investing time learning these nuances.

Finding the Balance: Security, Returns, and Usability

Here’s what bugs me about some wallet apps—they cram so many features that the interface becomes overwhelming. I’m all for power, but if you can’t quickly glance and understand your portfolio health, the tool loses value. Solflare strikes a decent balance, keeping things accessible while providing deep insights into validator stats and farming pools. The real kicker is how the wallet keeps evolving based on community feedback.

One last thought. As Solana’s ecosystem grows, so will the complexity of your portfolio. Tracking validator performance, staking rewards, and farming yields will get trickier. Relying on a wallet that updates in real-time and supports deep analytics isn’t just a convenience—it’s a necessity. If you’re looking to get started or upgrade your current setup, you can download the Solflare wallet here. It’s helped me stay on top of my game without feeling overwhelmed.

It’s fascinating how something as seemingly simple as picking a validator or tracking your tokens can ripple through your entire DeFi journey. At first, I underestimated it, but now it feels like mastering these basics is what separates the casual users from the pros. There’s still a lot I wanna figure out, but for now, having the right tools and a cautious approach makes all the difference.